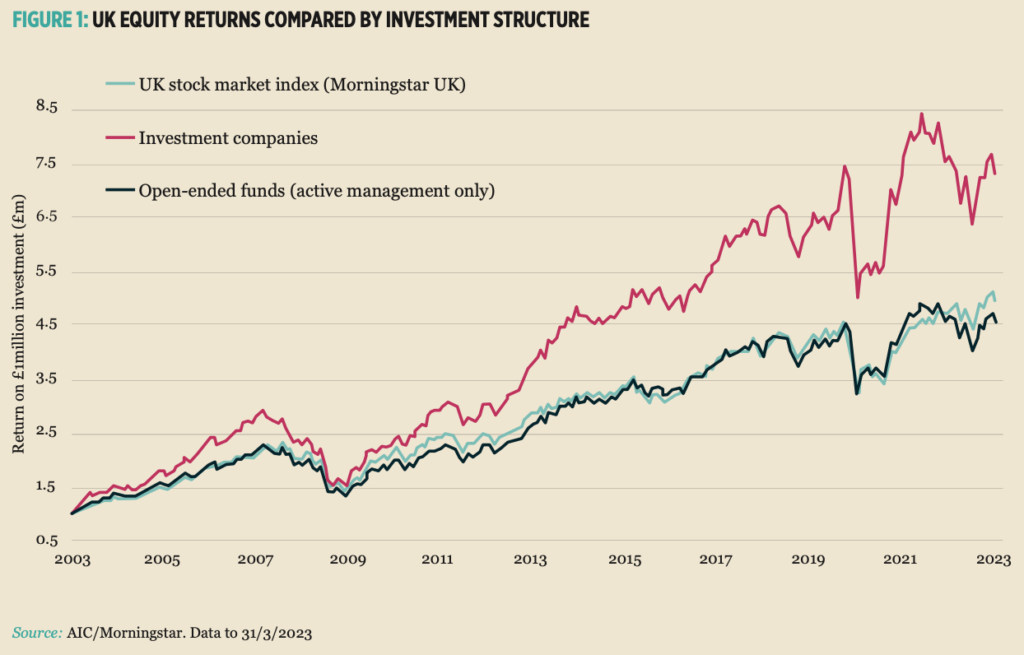

Research has consistently found that investment trusts have on average outperformed open-ended funds and unit trusts over the long-term.

Source: Pensions and Lifetime Savings Association Investment Companies Made Simple Guide – May 2023 – Page 4

Source: Pensions and Lifetime Savings Association Investment Companies Made Simple Guide – May 2023 – Page 4

While the past is not a guide to the future, looking back at the sector’s record (shown in the chart above) can offer insights to inform a strategic view of investment options.

Prior to the Retail Distribution Review (RDR) in 2012, open-ended funds could pay a trail commission to advisers (IFAs) for recommending their fund. As most IFAs were remunerated almost exclusively by commission, this incentivised the distribution of open-ended funds over other products, including investment trusts.

Post-RDR, there is no longer a compelling financial disincentive for IFAs to recommend investment companies. Yet, much of the structural bias towards open-ended funds remains, particularly in the advice market. This is despite the well-supported structural advantages that investment trusts offer.

The irony is, when you speak to many IFAs, they will tell you that they own investment trusts within their own investments, yet they do not recommend them to their own clients!

At B&G, we ‘eat our own cooking’ and have our own ‘skin in the game’ within our portfolios alongside our clients.

Why Now?

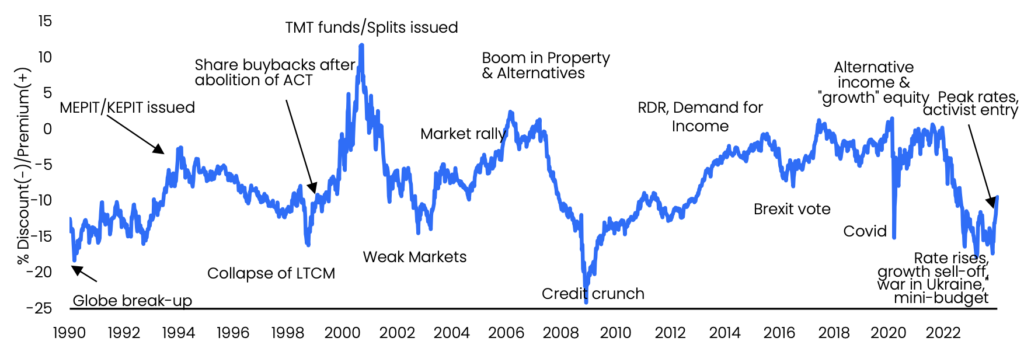

As investment trusts are publicly traded companies listed on the London Stock Exchange, you invest in them by buying shares at the price stated – the share price. However, investment trusts also have a net asset value (NAV). The NAV represents the total value of the trust’s assets minus any debts, and dividing this by the total number of issued shares gives the NAV per share. If the share price is higher than the NAV per share, the trust is trading at a premium, indicating high investor demand and popularity. Conversely, if the share price is lower than the NAV per share, the trust trades at a discount, suggesting lower popularity and demand. When the share price equals the NAV per share, the trust trades at par.

Source: Numis. Entire universe, including 3i to 29 December 2023

Source: Numis. Entire universe, including 3i to 29 December 2023

The chart above shows the sector average discount of the investment trust universe over the past 33 years – the current discount of the sector is in line with previous crisis levels.

Successful long-term investing involves having the courage to act once sentiment and fundamentals are no longer in tandem. History suggests that the best risk-adjusted returns have been generated when the sector discount has reached these levels.

The current disconnect between sentiment and fundamentals presents a generational opportunity to consider investing in an investment trust focused solution.

We know from their track record that investment trusts are a superb investment vehicle for private and institutional investors alike. Yet the sector is uniquely suffering from a regulatory regime which is making for a ‘double-counting’ of their costs, and this in turn is making them appear unduly expensive.

Investors are shunning them as a result. This is contributing to discounts having recently been at their widest since 1990, apart from a moment during the financial crash of 2008-09, while elevated discount volatility is resulting in further selling pressure.

As we enter 2024, after some lobbying, the Government is legislating to address the issue in order to provide the necessary ‘cover’ for the Financial Conduct Authority (FCA) to amend its guidance accordingly.

Narrowing of the Discount

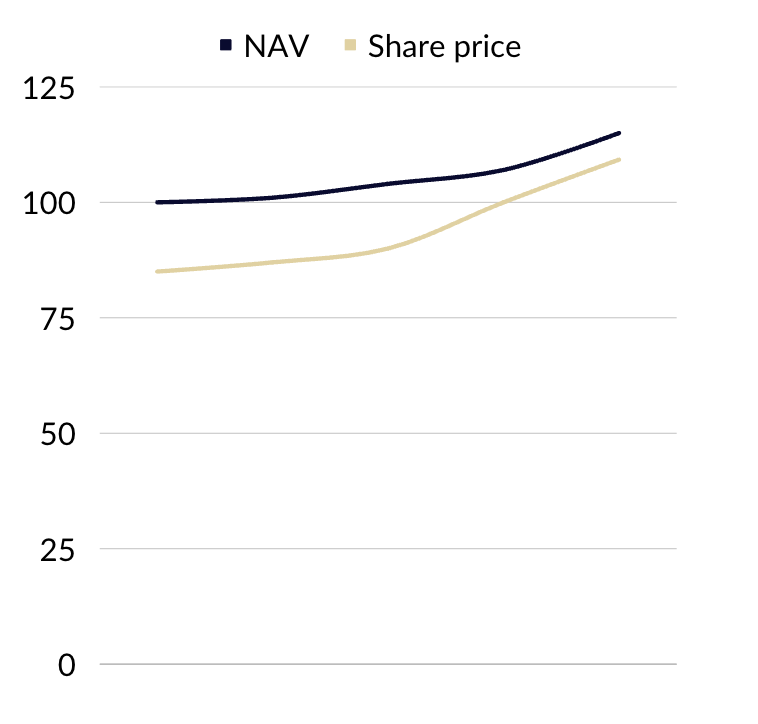

Chart is for illustrative purposes only

Chart is for illustrative purposes only

Once sentiment turns, a rising NAV and a narrowing discount are a powerful combination – they have a ‘double whammy’ effect on performance.

To use a straightforward example, an investment trust that sees its NAV increase by 15% at the same time as its discount narrows from a 15% to a 5% discount will generate a share price return of 29%, offering a significant kicker to performance. This approach is well- trodden ground for many professional, value-orientated investors and a real source of long-term performance.

The catalyst for this scenario can be an asset class coming back into favour, appointing a new lead manager with a good track record, strong performance or better marketing.

We share the sentiment of the Winterflood Investment Trust Research Team in their recent Annual Review piece:

Winterflood – Potential for a ‘double whammy’ – One of the key trends seen last year was the correlation between the investment trust sector average discount and UK Gilt yields. After widening, as market interest rates rose, discounts saw a material narrowing towards the end of last year when Gilt yields fell as markets priced in future rate cuts on the back of better-than-expected inflation prints. We think this trend is likely to continue, particularly in rate-sensitive asset classes such as Infrastructure, Renewable Energy Infrastructure, Property and Private Equity. In our view, the current discounts in these areas offer an attractive entry point, with the potential for a ‘double whammy’ of improving NAV performance and a positive re-rating when interest rates start to fall, especially if this acts as a catalyst for retail investors to re-enter the investment trust market. Nevertheless, we would caution that interest rates are unlikely to return to the near-zero levels seen for much of the last decade any time soon, and so the extent of this re-rating may well be limited to an extent. On the other hand, if we have reached the peak of the interest rate hiking cycle, as is widely thought to be the case, we do not expect to see significant downside discount risk from current levels.(1)

It is worth noting that open-ended funds will only ever generate the NAV performance and can not benefit from this scenario.

(1) Source: Winterflood – Annual Investment Trust Review of 2023 – 22 January 2024 – Page 4