Standalone Financial Advice

If a client wishes for Baron & Grant to manage their portfolio, the FCA stipulates we need to provide one-off ‘gateway’ financial advice to determine the most suitable portfolio, for which we charge £595. This fee represents less than 0.30% of our minimum £200,000 investment.

Full Financial Planning & Advice

Should clients require wide-ranging financial advice, one of our qualified financial advisers can help cater for an extensive range of personal requirements – from protecting a client’s family, pension and estate planning, to passing on wealth to chosen beneficiaries.

| Band | Initial Charge | Charge for Full Band |

|---|

| £0 to £500,000 | 2.0% | £10,000 |

| £500,000 to £1m | 1.0% | £5,000 |

| £1m+ | 0.0% | Nil |

Ongoing Advice Service (Optional) – To ensure ongoing suitability of your advice throughout your financial journey. Our ongoing advice fee is 0.5% of funds under management.

Discretionary Investment Management

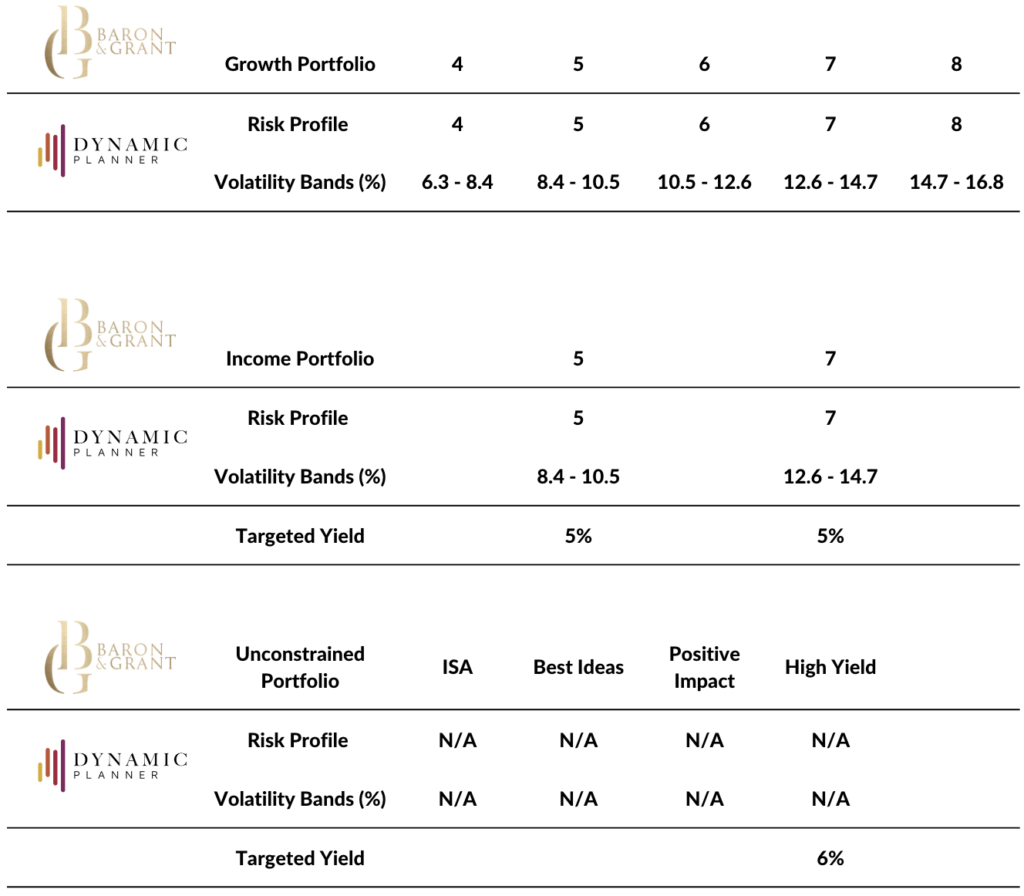

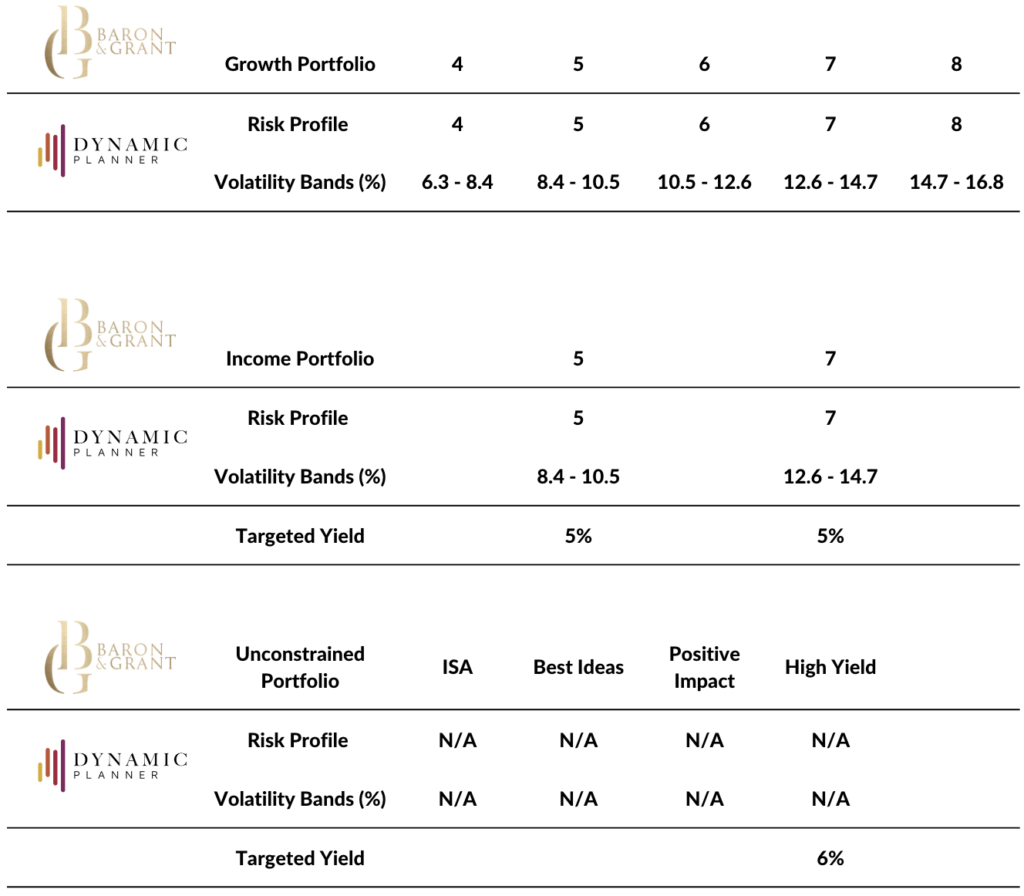

We offer a range of eleven model portfolios which span the full spectrum of risk-adjusted returns, thus enabling us to fully accommodate our clients’ different investment objectives and profiles.

Seven portfolios are categorised by Dynamic Planner Profiles 4 to 8 – the risk/reward remit increasing with the profiles. Five portfolios (B&G 4, 5, 6, 7, and 8) are focused on capital growth, while two are income-orientated, aligned to risk profiles 5 and 7, with a targeted yield in excess of 5%. We also offer four unconstrained portfolios – Positive Impact, ISA, High Yield (with a targeted yield in excess of 6%) and Best Ideas.

The major element of each portfolio consists of proven and respected investment trusts, which are then complemented by a carefully selected number of ETFs. We are fortunate in that there is a vast array of different investment options from which to construct our portfolios.

We continually monitor the portfolios to ensure an optimum balance between remit and risk. The investment committee formally meets once a month, and portfolio changes are undertaken quarterly or whenever required.

By providing financial planning, advice and discretionary investment management in-house, clients benefit from a cohesive approach to their wealth management.

Our discretionary investment management fee is 1% per annum, payable monthly in arrears.

The minimum investment for this service is £200,000.

Download Client Brochure

Third Parties

Annual platform charge

B&G does not hold client cash or assets. Client investments are managed on what is known as an investment/wrap platform. Our chosen platform partners are:

- M&G Wealth Platform

- AJ Bell Investcentre

- 7IM

- Transact

- Nucleus

- Wealthtime (formerly Novia)

Our chosen platform partners provide B&G with online dealing, valuation, and custody services. Clients can log in and access their portfolio valuation(s) at any time.

Each platform partner has its own charging structure; however, annual platform charges tend to start around 0.25% of the portfolio value. This charge tiers down for higher portfolio values, and family linking facilities are available (platform dependent). Charges are deducted monthly in arrears and are calculated in relation to a daily valuation.

A detailed breakdown of the recommended platform costs and charges will be provided as part of our advice process.

There are many benefits associated with investment/wrap platforms. These include:

- Institutional dealing capability with no dealing fees (platform dependent)

- Ability to consolidate existing products and policies onto one platform for ease of administration

- Ability to rebalance portfolios to keep them in line with desired risk profile – this is difficult and often costly to achieve on DIY platforms

- Access to up-to-date portfolio valuations online 24/7

- Consolidated reporting enabling accurate and efficient calculation of CGT liability (provided all chargeable assets are administered on the platform)

Personal Finance Portal (PFP)

Personal Finance Portal (PFP) is a service available only from a financial adviser. We use the portal to gather personal and financial information to try and ensure an efficient onboarding process. It also provides B&G with:

- Secure encrypted messaging

- Secure encrypted Document Vault – store financial documents online securely and fully backed up

- Access to Open Banking – a service that enables you to collate information from bank accounts and credit cards, giving you powerful insights

The underlying investments – Ongoing Charges Figure (OCF)

There has been an ongoing debate around the disclosure of investment trust costs within retail products and services. Investment trusts are listed companies with a share price as well as a NAV/share – investors receive the share price performance and not the NAV performance.

Stock markets enable foreseeable costs to be fully accounted for (or “discounted”) in the share price. Requiring the ongoing costs of investment trusts to be aggregated in the product costs of portfolios that hold them results in the double-counting of those costs.

The FCA has recently issued interim measures allowing investment companies and the funds/portfolios that hold them to disaggregate their total cost figures into component parts.

If the investment trusts’ costs were excluded from the single aggregated Ongoing Charges Figure (OCF), the weighted cost of our portfolios would be the weighted cost of the ETFs c.0.10% – 0.20%. Some of our unconstrained portfolios contain solely investment trusts; hence, the OCF for these portfolios would be zero.

The UK is the only market in the world where public companies (including investment trusts) are subject to any form of MiFID and PRIIPS regulations and, therefore, report costs and charges. No other public company has to abide by the same level of misleading cost disclosure. M&S and BP do not have to report their costs despite the extent of these costs in managing a wide range of (sometimes expensive) assets. These costs are reflected in share prices – the market has taken them on board. The same should be true of investment trusts given they too are public companies managing a range of assets.

The irony is that not even the EU now adheres to these regulations – not a single company listed on any EU exchange is now subject to these MiFID and PRIIPS regulations. Only in this country are we still adhering to, if not gold-plating, such regulations.

The Government has accepted the urgency of the situation. Two Statutory Instruments (SIs) are being introduced to the House of Commons. SIs secure modest changes to legislation quickly without having to pass another Act. These will, in effect, place the MiFID and PRIIPS regulations onto the FCA rulebook – thereby providing the legislative cover for it to introduce the required guidance change.

Cost is the primary driver for investment management and selection for many investment solutions. At times, this can limit an investible universe, reduce portfolio diversification, or result in an unsuitable investment vehicle/structure being selected for a particular asset class, e.g. holding illiquid assets in an open-ended structure.

While we are very cost-conscious in portfolio construction and investment selection, our primary driver is to generate the best risk-adjusted returns for clients net of all costs and charges.

Another area we have been campaigning for on the cost front is eliminating stamp duty on investment company purchases – we have lobbied for this directly with the past two Chancellors. To level the playing field between investment companies and open-ended funds, the AIC has recommended that stamp duty is abolished on the shares of UK investment companies, UK REITs and VCTs.

Security of assets

B&G have conducted extensive due diligence on our platform partners to ensure financial strength, resilience, stability, ongoing investment, functionality and competitive fee structures.

Your cash and assets are held separately from their accounts and from those with whom they place the assets. As such, should a platform be wound up, your cash and assets will remain yours and any administrator is obliged to return them to you as part of the wind-down process.

Clients also have access to the Financial Services Compensation Scheme (FSCS) for qualifying investments and cash – subject to the limits.

Please find each platform’s security of assets literature below:

M&G Wealth – Security of Assets

AJ Bell Investcentre – Security of Assets

7IM – Security of Assets

Further details on the security of assets for the respective platforms can be provided upon request.

Due diligence

B&G is an independent, owner-managed business that was established in 2019. B&G has no debt and a strong balance sheet and liquidity position. The UK Investment Firms Prudential Regime (IFPR) came into force on 1st January 2022, and B&G is classed as a MIFIDPRU Investment Firm. As a MIFIDPRU investment firm, B&G’s own funds requirements will be the highest of:

- Its Permanent Minimum Capital Requirement (PMR) of £75,000

- A Fixed Overheads Requirement (FOR) of 3 months fixed costs

The FCA expects firms to assess, at least annually, the full financial resource requirements in relation to specific risks that a firm faces. As a firm that falls within the scope of the IFPR, B&G has submitted its Internal Capital Adequacy and Risk Assessment (ICARA) to the FCA. Based on the firm’s unaudited financial accounts for the year ended 31st December 2023, B&G had more than 5.8 times its FCA own funds requirements.

Our compliance consultants are threesixty Services LLP. Threesixty delivers support and compliance services to over 950 directly regulated IFA practices, including over 100 discretionary investment management firms, equating to over 10,000 registered individuals. Their experts provide an unparalleled understanding of the issues impacting discretionary management firms, and their service ensures our in-house compliance resource gets the help, expertise and external opinion it needs.

With regards to our track record, whilst we have only been authorised since the 4th January 2021, we can point to the track record of John Baron’s actual real investment trust portfolios (‘Growth’ and ‘Income’) in his popular monthly column in the Investors’ Chronicle magazine. John has reported on these portfolios monthly, trade by trade, since the 1st January 2009. These are two of ten actual portfolios that John has managed, which have an auditable track record of performance.

Our portfolios share the same foundation, DNA, style, and themes.