We founded Baron & Grant (B&G) to harness the many advantages of investment trusts for the benefit of our clients. A track record of outperformance, a bespoke service and portfolios tailored to individual circumstances make for a powerful combination. With the help of others, we also hope to help investors generally better understand how investment trusts can achieve financial objectives

B&G is a financial planning, advice and discretionary investment management business that specialises in managing investment trust focused portfolios, complemented by a carefully selected range of exchange-traded funds (ETFs).

This approach is different to the vast majority of investment or wealth managers who run portfolios consisting mainly of direct equities and other forms of collective funds such as unit trusts and open-ended investment companies (OEICS). Such funds, on average, have been shown to underperform investment trusts.

Independent research conducted by The Lang Cat concluded the following:

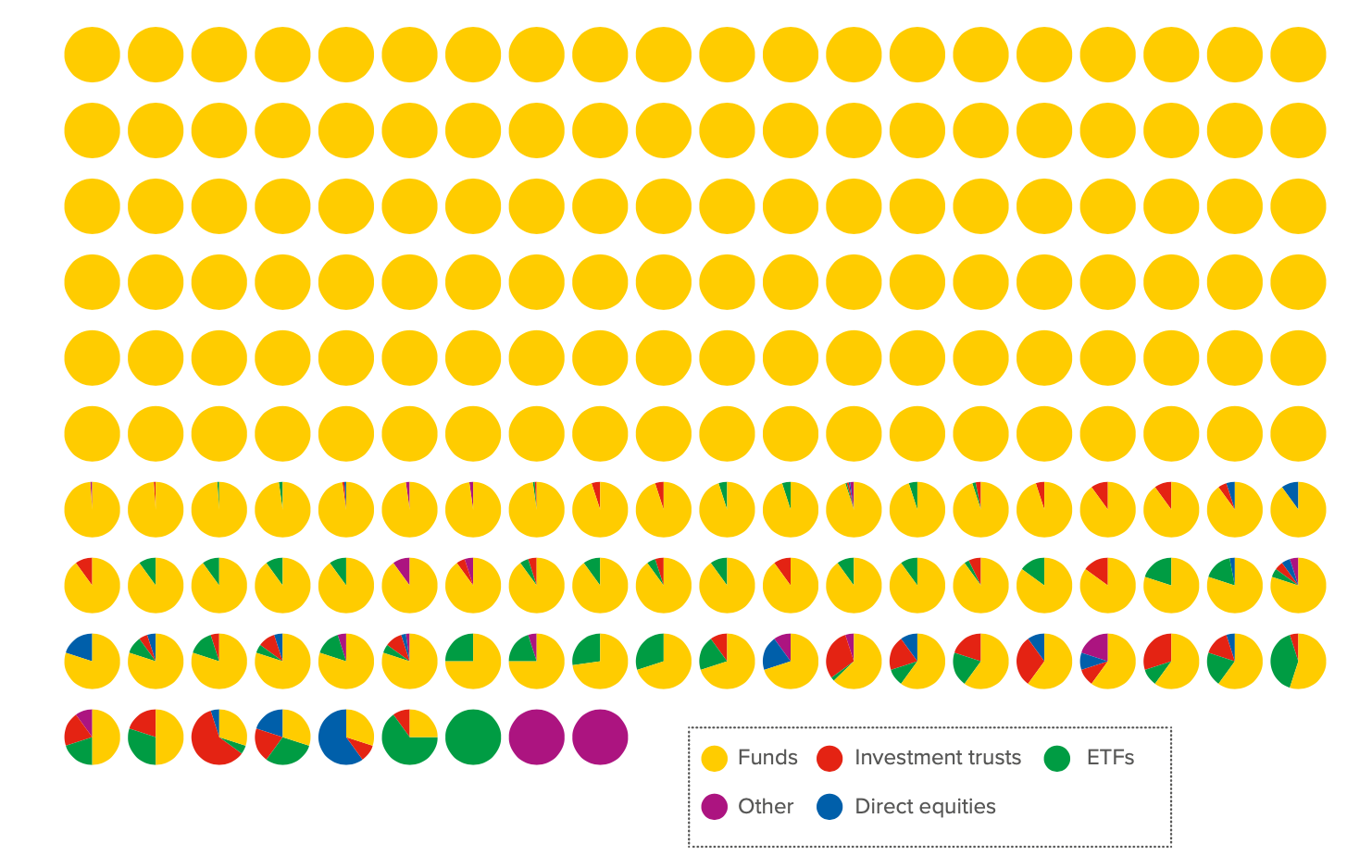

“Funds dominate the model portfolio world. Based on our State of the Adviser Nation (SOTAN) research, the total mean average use of funds as opposed to other asset types as the building blocks in models is 91%. Anything else is (currently) a minority sport. Our graphic below illustrates the asset types used by respondents of our SOTAN research who run their own model portfolio range. Each ‘mini-pie’ represents an individual respondents asset mix for their models.”

Source: The Lang Cat publication – Practically Speaking. Investment Companies within Centralised Investment Propositions – November 2020 – Page 7

Of the 189 respondents, not one firm exclusively used both investment trusts and ETFs in their portfolios!