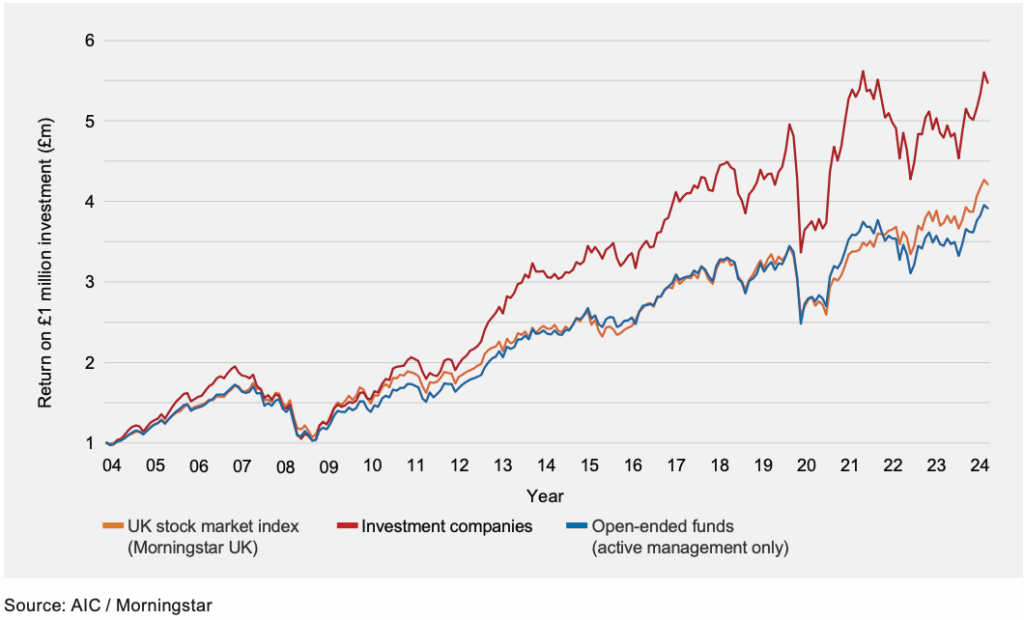

Research has consistently found that investment trusts have on average outperformed open-ended funds and unit trusts over the long-term.

As the chart above shows, investing in UK shares using an investment trust would have earned a higher return than using a tracker or actively managed open-ended funds over the long term.

Before the Retail Distribution Review (RDR) in 2012, open-ended funds were able to pay trail commissions to advisers (IFAs) for recommending their products. Given that most IFAs relied heavily on commission-based remuneration, this created a strong incentive to prioritise open-ended funds over other investment vehicles, such as investment trusts.

Since the introduction of the RDR, which eliminated commission payments, there is no longer a financial disincentive for IFAs to recommend investment trusts. However, the structural bias in favour of open-ended funds persists, particularly within the advice market. This is despite the clear structural advantages that investment trusts offer, which are well-documented and supported.

Ironically, many IFAs personally invest in investment trusts but still choose not to recommend them to their clients.

At B&G, we align our interests with those of our clients by investing in our own portfolios – demonstrating that we truly ‘eat our own cooking’ and have ‘skin in the game.’

Why Now?

Source: AIC/Morningstar

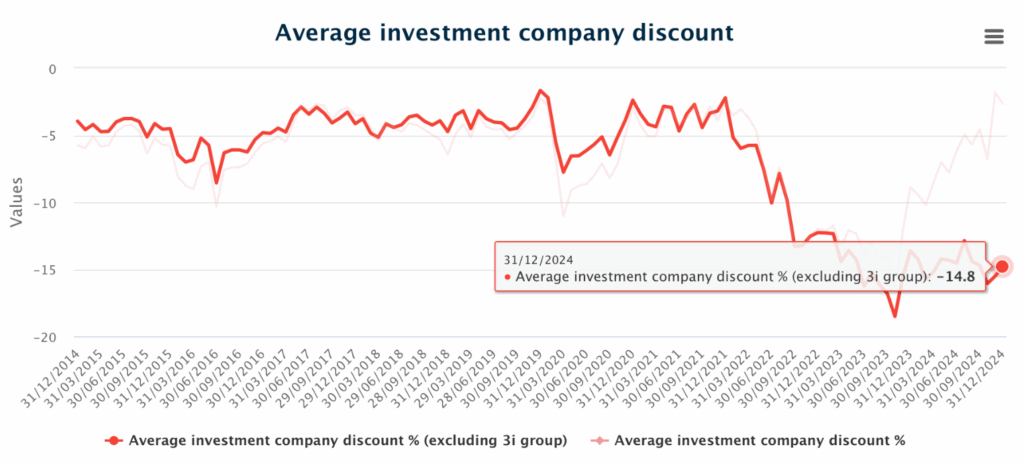

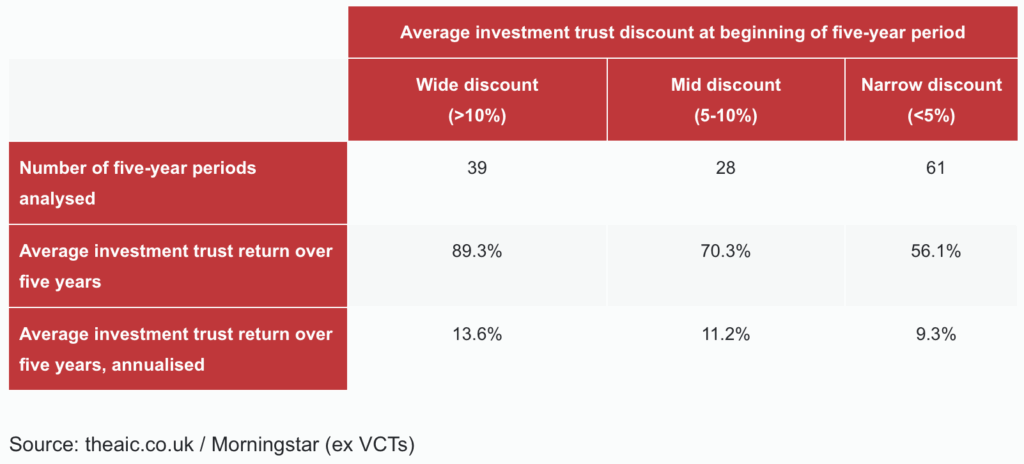

The chart above highlights that the sector average discount at the end of 2024 was -14.8%. According to research from the AIC, investing when the average investment trust discount is more than -10% may lead to significantly better returns over the subsequent five years. The AIC’s analysis of investment trust returns since 2008 shows that when the average discount exceeded -10%, the average investment trust generated a return of 89.3% over the following five years¹.

¹Source: theaic.co.uk/Morningstar. Based on an analysis of 128 five-year periods, the first period ended in June 2013 and the final in January 2024 (all periods start and end at a month-end).

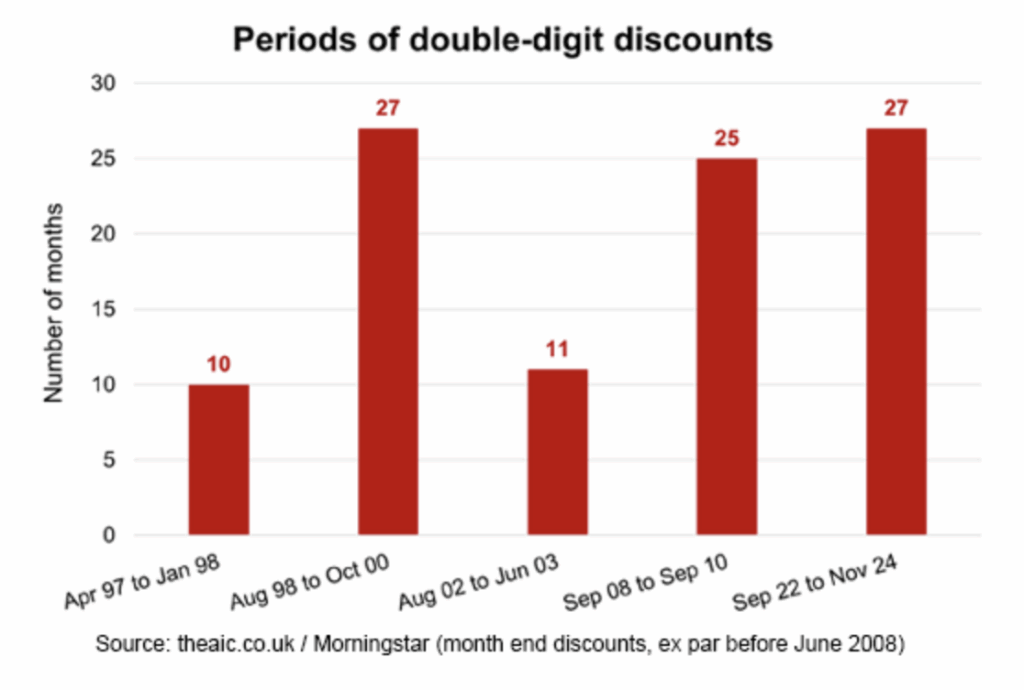

Bargains, but for how much longer?…(as shown by the chart below) periods of double-digit discounts come to an end eventually. This one has lasted a draining 27 months…two months longer than the one we saw during the financial crisis.

Once sentiment turns, a rising NAV and a narrowing discount are a powerful combination – they have a ‘double whammy’ effect on performance.

To use a straightforward example, an investment trust that sees its NAV increase by 15% at the same time as its discount narrows from a 15% to a 5% discount will generate a share price return of 29%, offering a significant kicker to performance. This approach is well-trodden ground for many professional, value-orientated investors and a real source of long-term performance. It is worth noting that open-ended funds will only ever generate the NAV performance and can not benefit from this scenario.

While risks persist for 2025 — including the unpredictable presidency of Donald Trump, high valuations of US technology stocks, a global trade war, a slower-than-expected pace of interest rate cuts, and the potential resurgence of inflation — we remain optimistic about generating strong risk-adjusted returns. This optimism is driven by the opportunity to capitalise on historically wider discounts and attractive dividend yields within the sector.

We anticipate corporate activity will remain elevated in 2025, along with record levels of share buybacks, as the sector undergoes continued “Darwinism”, emerging “fitter, leaner, and stronger”. This evolution should be supported by a resolution to the cost disclosure issue and a healthy macroeconomic backdrop.